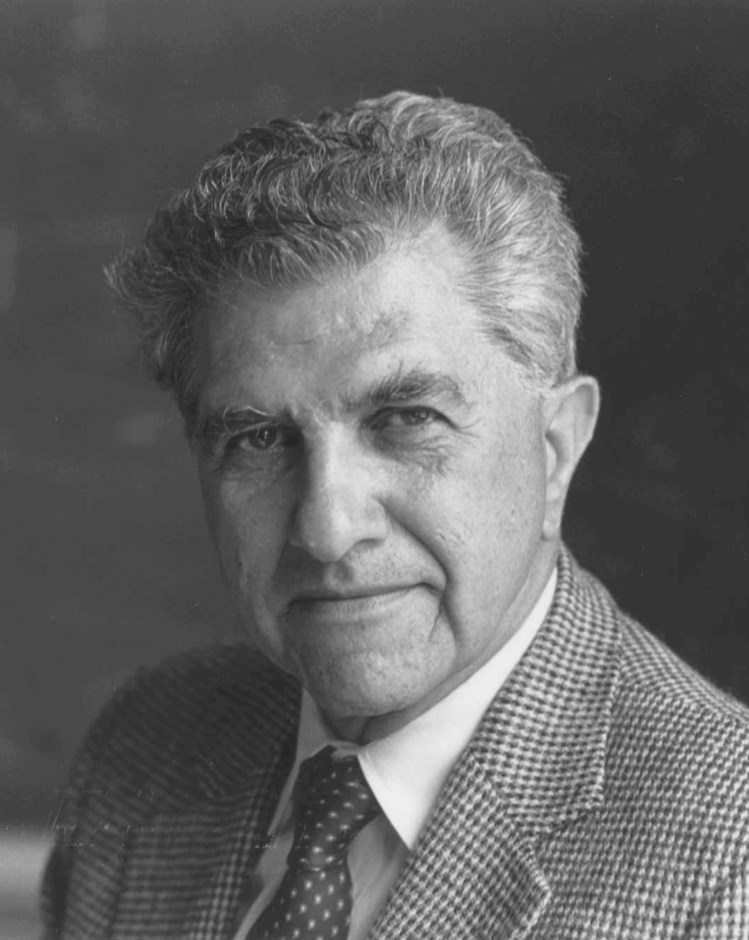

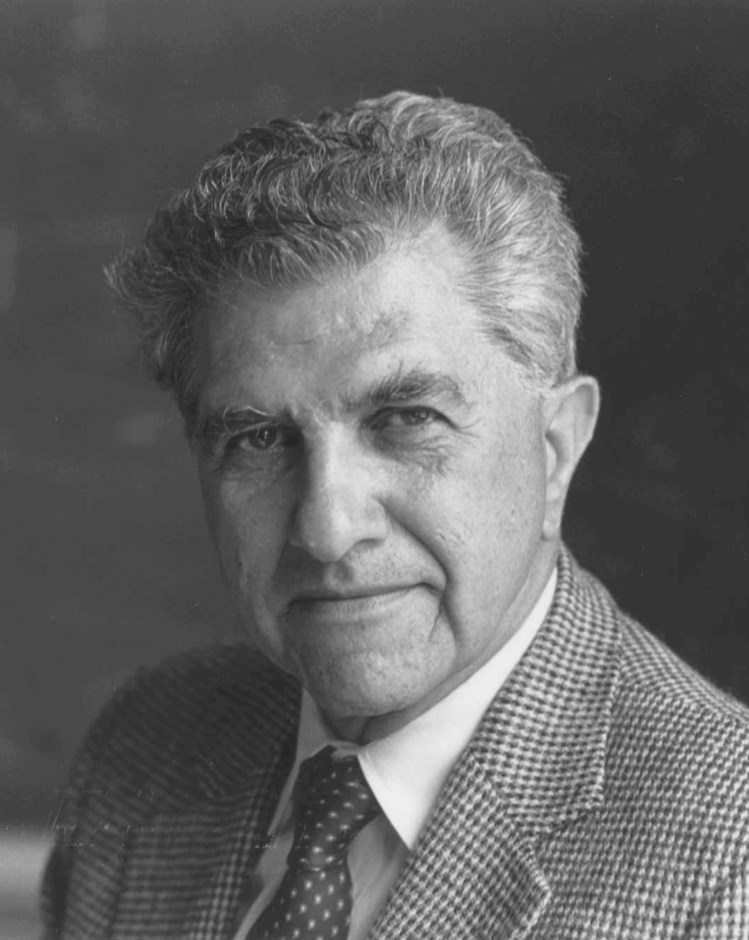

Learn More About Merton Miller

Miller's contribution was the Modigliani-Miller theorem, which he developed with Franco Modigliani while both were professors at the Carnegie Institute of Technology. Read Professor Miller's Nobel lecture, "Leverage."

Miller was a strong defender of the view that futures contracts, just like other products, are valuable to those who buy them. Therefore, he argued, government regulation of these contracts is likely to do more harm than good.

He was an activist supporter of free-market solutions to economic problems, very much in the tradition of fellow University of Chicago laureates Milton Friedman (1976), Theodore Schultz (1979), and George Stigler (1982).

He served as a public director on the Chicago Board of Trade (1983–85) and the Chicago Mercantile Exchange from 1990 until his death in 2000. Following the market crash of October of 1987, Miller served as chairman of the CME’s special academic panel to conduct the post-mortem.

He worked during World War II as an economist in the Division of Tax Research at the Treasury Department, and subsequently in the Division of Research and Statistics of the Board of Governors of the Federal Reserve System.

Academic Career

Miller earned his undergraduate degree at Harvard University in 1944 and went on to work as a tax expert at the US Treasury Department. He later earned his PhD in economics at Johns Hopkins University in 1952.

His first academic appointment after receiving his doctorate was visiting assistant lecturer at the London School of Economics. Miller taught at Carnegie from 1953 to 1961, and in 1961 became a professor at the University of Chicago Booth School of Business, where he was the Robert R. McCormick Distinguished Service Professor. He was on the faculty until his retirement in 1993, although he continued teaching at the school for several more years.